What Is Solana? Beginner's Guide

- DEXArea

- Wiki

- Solana

- Solana Basics

- What Is Solana

What Is Solana?

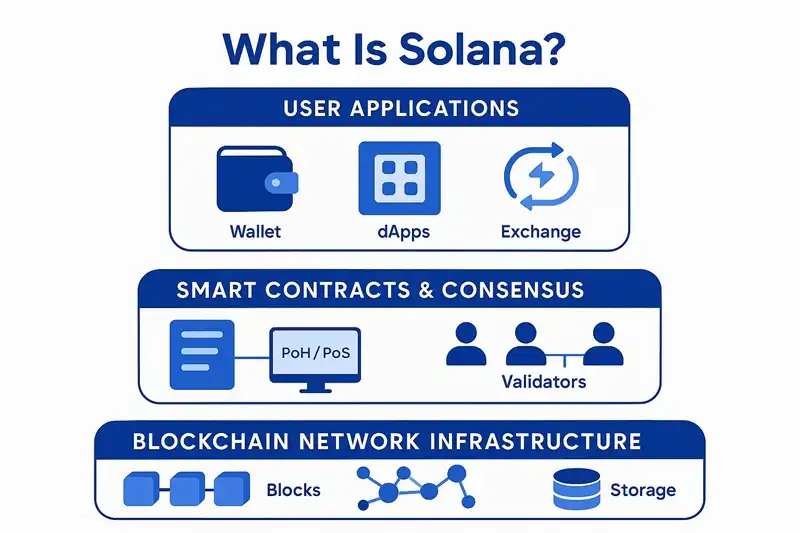

Solana is a high-performance blockchain launched in 2020, designed for building decentralized applications (dApps) and DeFi platforms. It uses a combination of Proof of Stake (PoS) and a unique innovation called Proof of History (PoH) to achieve fast transaction speeds and low fees. SOL is the network’s native cryptocurrency, used for paying transaction fees, staking, and governance.

📋 About This Guide

Written by: DEXArea Knowledge Team

About DEXArea: DEXArea is a Solana token toolkit used by thousands of creators to create and manage SPL & Token-2022 tokens. Learn more about us →

First published: November 2025

Last updated: December 2025

What is Solana - Blockchain Fundamentals and Key Features

The Problem Solana Aims to Solve

Before Solana, many blockchains faced challenges that limited their practical use:

- Bitcoin: Transactions can take 10 minutes or longer to confirm

- Ethereum: Fees can spike significantly during periods of high demand

- Many older chains: Limited to processing 10–30 transactions per second

Solana’s design aims to address these issues:

✅ Fast Finality: Transactions typically confirm in under a second

✅ Low Fees: Fees are usually under $0.01 during normal network conditions

✅ High Throughput: Designed to handle up to 65,000 transactions per second (theoretical maximum)

How Solana Works (Simplified)

1. Proof of Stake (PoS)

Instead of energy-intensive mining like Bitcoin, Solana uses Proof of Stake. SOL holders can “stake” their tokens to help secure the network and may earn staking rewards in return. Note: Staking rewards are not guaranteed and depend on network conditions and validator performance.

2. Proof of History (PoH)

Solana’s key innovation is Proof of History—a cryptographic clock that timestamps transactions before they’re processed. This allows validators to agree on the order of events without extensive communication, enabling faster consensus.

3. Validators

Thousands of validator nodes around the world process transactions, maintain network security, and store blockchain data. Anyone meeting the technical and staking requirements can run a validator.

What Can You Do on Solana?

For Everyday Users

Solana enables various crypto activities with typically fast and affordable transactions:

- Send payments to anyone globally in seconds

- Trade and collect NFTs with relatively low transaction costs

- Access DeFi applications for lending, trading, and other financial services

- Play blockchain-based games with near-instant transactions

- Make micropayments that would be impractical on higher-fee networks

For Developers

Solana provides infrastructure for building scalable applications:

- Build dApps designed to serve large user bases

- Create DeFi protocols and financial products

- Develop blockchain games with in-game economies

- Launch NFT marketplaces and digital collectibles

- Build social platforms leveraging blockchain technology

Real-World Examples

DeFi Applications

- Jupiter: One of the largest DEX aggregators on Solana

- Marinade Finance: Liquid staking protocol

- Solend: Lending and borrowing protocol

Note: DeFi protocols carry inherent risks including smart contract vulnerabilities, liquidity risks, and potential loss of funds. Always research protocols thoroughly before use.

NFT Platforms

- Magic Eden: Leading NFT marketplace on Solana

- Tensor: NFT trading platform with advanced features

- Various collections: Thousands of NFT projects across art, gaming, and utility

Note: NFT values are highly speculative and can decrease significantly. Only spend what you can afford to lose.

Gaming

- Star Atlas: Space exploration game with blockchain economics

- Aurory: RPG-style game with collectible creatures

- Various play-to-earn games: Gaming projects with token-based rewards

Note: “Earn” mechanics in blockchain games are not guaranteed income. Token rewards depend on game economics, market conditions, and can decrease in value.

Comparing Solana to Other Blockchains

The following tables provide simplified comparisons for educational purposes. Actual performance varies based on network conditions, congestion, and market activity.

Speed Comparison

| Blockchain | Typical Transaction Time | Notes |

|---|---|---|

| Bitcoin | 10+ minutes | Designed for security over speed |

| Ethereum | 15 sec – several minutes | Varies with network congestion |

| Solana | Under 1 second (typical) | May vary during high demand |

Cost Comparison

| Blockchain | Typical Fee Range | Notes |

|---|---|---|

| Bitcoin | $0.50 – $10+ | Varies with network demand |

| Ethereum | $1 – $50+ | Can spike during congestion |

| Solana | Under $0.01 (typical) | May increase during peak usage |

Throughput Comparison

| Blockchain | Theoretical TPS | Notes |

|---|---|---|

| Bitcoin | ~7 TPS | By design, prioritizes decentralization |

| Ethereum | 15–30 TPS (L1) | Layer 2 solutions add capacity |

| Solana | Up to 65,000 TPS | Theoretical max; real-world varies |

The Solana Ecosystem

Solana’s ecosystem continues to develop across several areas:

- Security Improvements: Ongoing protocol upgrades and audits

- Growing Application Base: New projects launching regularly

- Developer Tools: Expanding SDKs, documentation, and resources

- User Experience: Wallet improvements and simplified onboarding

Note: Ecosystem growth does not guarantee investment returns. Many projects in any blockchain ecosystem fail or lose value.

❓ Frequently Asked Questions

Q: Is Solana better than Ethereum?

A: Each blockchain has different strengths. Solana is typically faster and has lower fees, while Ethereum has a larger ecosystem, more established DeFi protocols, and a longer track record. The “better” choice depends on your specific needs and priorities. Many users and developers work across multiple blockchains.

Q: Can I lose money on Solana?

A: Yes, you can lose money in multiple ways:

- Market volatility: SOL and token prices can drop significantly

- Smart contract risks: Bugs or exploits in protocols can result in lost funds

- Protocol failures: DeFi protocols can fail or become insolvent

- User errors: Sending to wrong addresses, losing private keys, or falling for scams

- Phishing and scams: Fake websites, malicious transactions, and social engineering attacks

Always verify addresses, never share your seed phrase, and only use funds you can afford to lose entirely.

Q: Is Solana safe to use?

A: Solana uses established cryptographic security and has been operating since 2020. However, “safe” is relative:

- Network security: The protocol itself is secured by thousands of validators

- Smart contract risk: Individual apps may have vulnerabilities

- User responsibility: Security also depends on how you manage your wallet and private keys

- Market risk: Asset values can decline regardless of network security

Use reputable wallets, verify all transactions, and follow security best practices.

Q: Who controls Solana?

A: Solana is a decentralized network with no single controlling entity:

- Solana Foundation: A non-profit that supports ecosystem development, grants, and community initiatives

- Solana Labs: A company that contributes to core protocol development

- Validators: Thousands of independent validators worldwide secure the network and process transactions

- Community: Token holders can participate in governance decisions

While early development was centralized, the network has progressively decentralized over time. Validator distribution and governance participation continue to evolve.

Q: Is Solana centralized?

A: Solana is designed to be decentralized, though debates exist about the degree of decentralization:

- Anyone meeting technical requirements can run a validator

- No single entity controls transaction processing

- Hardware requirements for validators are higher than some other blockchains, which some critics argue limits participation

The network continues to work toward greater decentralization through initiatives like the Solana Foundation’s delegation program.

Q: What if Solana goes down?

A: Solana has experienced network outages in the past, typically during periods of extreme transaction volume. When the network is down:

- Transactions cannot be processed

- Funds remain in wallets but cannot be moved

- DeFi positions may be affected (e.g., liquidations during downtime)

The development team has implemented various improvements to increase reliability. Check Solana Status for real-time network health.

Build on Solana with DEXArea (Optional)

If you’re interested in creating tokens or building on Solana, DEXArea provides tools to help:

- Create a Solana Token — Launch SPL or Token-2022 tokens without coding

- Create a Liquidity Pool — Set up trading pairs for your token

- Update Token Metadata — Customize name, symbol, and logo

- Multi-send Tokens — Distribute tokens to multiple wallets

These are tools, not investment recommendations. Creating a token does not guarantee value or success.

📝 Summary

Solana is a high-performance blockchain designed for speed and low transaction costs. Key points:

- Launched in 2020, using Proof of Stake and Proof of History

- Designed for up to 65,000 TPS with sub-second finality

- Transaction fees typically under $0.01

- Used for DeFi, NFTs, gaming, and various dApps

- SOL is the native token for fees, staking, and governance

Like all cryptocurrencies, Solana involves significant risks including volatility, technical issues, and potential loss of funds. This guide is educational only—always do your own research before participating in any blockchain ecosystem.

For a full roadmap of Solana concepts, see Solana Basics Overview.

📚 References and Further Reading

- Solana Documentation — Official technical documentation and developer guides

- Solana Foundation — Official website, announcements, and ecosystem overview

- Solana Whitepaper — Original technical whitepaper explaining Proof of History

- CoinMarketCap: Solana — Market data and basic information (third-party source)

- Messari: Solana Profile — Research and analysis (third-party source)

External links are provided for educational purposes. DEXArea does not control or endorse third-party content.

🔗 Related Topics

Continue learning about Solana:

- Wallet Basics — How to set up and secure a Solana wallet

- Transactions and Fees — Understanding how Solana transactions work

- How Solana Works — Technical deep dive into the protocol

- Solana vs Other Blockchains — Detailed comparison with other platforms