Types of Liquidity Pools on Solana

Introduction

Liquidity pools are the engine of Solana DeFi. Without them, swaps, yield farms, lending (using LP tokens as collateral), and governance wouldn’t exist. Understanding the different pool types helps you navigate the real Solana ecosystem—not just theory, but where you’ll actually trade and provide liquidity.

For many new traders in Solana’s memecoin scene, the first experience is often with a bonding-curve pool on pump.fun. Once tokens graduate, trading usually shifts to CPMM pools on FluxBeam or Raydium. More advanced users who want to provide liquidity themselves often turn to CLMMs like Orca Whirlpools or Raydium CLMM. Meanwhile, everyday users also interact directly with stablecoin pools, SOL/USDC pairs, or Jupiter swaps without touching launch curves at all.

Pool Types - Understanding Different Liquidity Pool Models on Solana

Why Solana Makes Pools Different

Solana’s design fundamentally changes how you interact with liquidity pools:

- Low fees + high TPS: CLMMs are viable for retail users—it’s cheap to rebalance ranges, unlike Ethereum where gas costs can eat profits

- NFT-native LP positions: Fits Solana’s culture of NFTs + marketplaces (e.g., Whirlpool NFTs tradable on Magic Eden)

- Aggregators (Jupiter): Automatically route through multiple pool types, so most users don’t even notice which pool type they’re using

- Composability: LP tokens/positions can be staked, lent, or even traded as NFTs

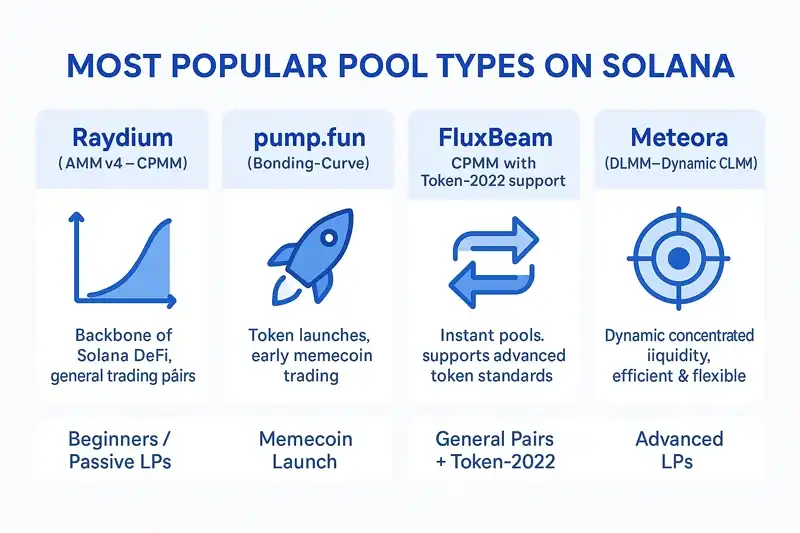

Pool Types You’ll Actually Use on Solana

CPMM (Constant Product Market Maker)

Where you’ll see these: Raydium v4 AMM, FluxBeam, most general trading pairs

How they work: Classic x·y=k formula ensures a constant product of the two asset reserves. Price changes smoothly along a hyperbolic curve.

Why Solana users choose CPMM:

- FluxBeam: One of the most used DEXs for new Solana tokens with extra tooling (Token-2022 support, bot integrations, instant pool creation)

- Raydium v4: The backbone of Solana DeFi, handling most major pairs

- Set it and forget it: Simple, passive management

Best for: General token pairs, beginners, passive LPs

CLMM (Concentrated Liquidity Market Maker)

Where you’ll see these: Orca Whirlpools, Raydium CLMM, Crema, Invariant

How they work: Liquidity providers set specific price ranges, concentrating capital within those bands. Positions are represented by NFTs.

Why Solana users choose CLMM:

- Higher capital efficiency: Earn more fees with less capital when price stays in range

- Tighter spreads: Better pricing for active traders

- NFT positions: Tradeable on marketplaces, fits Solana’s NFT culture

Best for: Active, blue-chip pairs, experienced LPs willing to monitor and adjust ranges

Stable-Swap

Where you’ll see these: Saber (legacy, stablecoins), Lifinity (oracle-based stable/volatile)

How they work: Optimized curve for assets with similar prices. Very flat around the peg, allowing large trades with minimal slippage.

Why Solana users choose stable-swap:

- Low slippage: Perfect for stablecoin swaps (USDC/USDT)

- Liquid staking derivatives: SOL/mSOL pairs

- Reduced impermanent loss: When assets maintain their peg

Best for: Stablecoin trading, correlated assets, low-slippage needs

Bonding-Curve Launch Pools

Where you’ll see these: pump.fun (now migrating to PumpSwap), Raydium Launchpad

How they work: Price rises with buys, falls with sells. No traditional LPs during bonding phase—the curve itself holds reserves. LPing starts once the token migrates to traditional pools.

Why Solana users use bonding-curve:

- Early access: Get into tokens before they hit major DEXs

- Launch mechanism: The #1 way newcomers touch liquidity on Solana

- Graduation: Early trading happens on the curve → at graduation, liquidity moves to PumpSwap or a Raydium pool, where standard LPing begins

Best for: Early memecoin trading, launch participants

Weighted/Hybrid

Where you’ll see these: Balancer-style pools are rare, but experiments exist on GooseFX/Invariant

How they work: Custom asset weights (e.g., 80/20 pools) with flexible pricing mechanisms.

Why Solana users might choose weighted:

- Token baskets: Custom asset ratios for indices

- Special tokenomics: Assets with unusual distribution needs

- Experimental: Cutting-edge DeFi concepts

Best for: Advanced users, token baskets, experimental DeFi

Which Pool Should I Use? (By Persona)

Beginners / Passive LPs

- Start with: Raydium CPMM, FluxBeam

- Strategy: “Set it and forget it”

- Why: Simple mechanics, broad market exposure, minimal management

Active LPs

- Choose: Orca Whirlpools, Raydium CLMM

- Strategy: Tighter ranges, higher fees, but needs monitoring

- Why: Higher capital efficiency, better fee generation

Stablecoin Traders

- Use: Lifinity, Saber (stable-swap)

- Strategy: Low slippage, minimal impermanent loss

- Why: Optimized for pegged assets

Meme Traders

- Access: pump.fun bonding-curve

- Strategy: Early access, but very high risk

- Why: Get into tokens before they hit major DEXs

Advanced Users

- Explore: Weighted/Hybrid experiments (indices, token baskets)

- Strategy: Custom solutions for complex needs

- Why: Maximum flexibility and control

How Pool Types Price Trades

- CPMM constant product: Smooth hyperbolic curve, constant product maintained

- CLMM price bands: Liquidity active only within specific ranges, high slippage outside

- Stable-swap flatter curve: Very flat near peg, steeper further from peg

- Bonding-curve: Price moves with each trade, no LP reserves during bonding phase

- Weighted pools: Custom ratios ≠ 50/50, pricing adjusts based on weights

LP Experience & Fees

- Fee realization: CPMM and stable-swap fees accrue into reserves, increasing LP token value. CLMM fees collected per position, may need claiming

- Management effort: CPMM and stable-swap are passive. CLMMs require active management and range adjustments

- Range resets: When price moves out of range, CLMM positions become inactive. LPs pay transaction fees to reset ranges (cheap on Solana vs. Ethereum)

User Experience (Swaps)

- Jupiter routing: Most users don’t choose pool types—Jupiter automatically routes through multiple pools for best price

- Slippage and price impact: Deep liquidity reduces slippage. Right fee tier ensures efficient trading

- Pool selection: Stablecoin swaps need very low fees, volatile pairs need higher fees to compensate LPs

Pool Types Comparison

Quick Reference Table

| Aspect | CPMM (x·y=k) | CLMM (Concentrated) | Stable-swap | Bonding-Curve | Weighted/Hybrid |

|---|---|---|---|---|---|

| Examples | Raydium v4, FluxBeam | Orca Whirlpools, Raydium CLMM | Saber, Lifinity | pump.fun, Raydium Launchpad | GooseFX, Invariant |

| Capital efficiency | Medium | High (in-range) | High near peg | N/A (no LPs) | Varies |

| Management effort | Low | Medium–High | Low–Medium | N/A | Medium |

| Fee realization | Into reserves | Per position &/or reserves | Into reserves | N/A | Varies |

| IL risk | Moderate | Range/out-of-range dynamics | Lower near peg | N/A | Depends on weights |

| Best for | Common pairs, beginners | Active blue-chip pairs | Stable/pegged assets | Early memecoin trading | Index/basket tokens |

Use-Case Fit Matrix

| Use case | CPMM | CLMM | Stable-swap | Bonding-Curve | Weighted/Hybrid |

|---|---|---|---|---|---|

| Small-cap trading | Good | Possible | Not ideal | Strong | Possible |

| Blue-chip pairs | Good | Strong | Not ideal | Not ideal | Possible |

| Stablecoin swaps | Possible | Possible | Strong | Not ideal | Possible |

| Early memecoin trading | Not ideal | Not ideal | Not ideal | Strong | Not ideal |

| Basket/Index | Possible | Not ideal | Not ideal | Not ideal | Strong |

| Low-maintenance LP | Strong | Not ideal | Strong | N/A | Medium |

Risks & Safeguards

Smart Contract Risk

- Stick to widely used protocols: Raydium, Orca, and FluxBeam are popular and well-established

- Always verify audits and program IDs: Check token addresses and program IDs yourself

Impermanent Loss (IL)

- CPMM: Moderate IL risk

- CLMM: Range-out risk when price leaves your active range

- Stable-swap: Minimal IL when assets stay near peg

- Bonding-curve: No impermanent loss for users, since there are no LPs during the bonding phase — only traders against the curve

Solana-Specific Risks

- Stacked risk warning: Using LP tokens in farms/lending = stacked risks (pool risk + farm risk + lending risk)

- Bot activity: Cheap tx fees mean bots are everywhere → toxic order flow risk is higher than on slow chains

- Bonding-curve risks: Creator rugs, instant liquidity drain, post-migration liquidity drying up

General Precautions

- Start small: Never invest more than you can afford to lose

- Understand the lifecycle: Especially for bonding-curve pools that migrate to traditional pools

- Monitor ranges: For CLMM positions, actively manage your price ranges

📝 Conclusion

Solana’s pool ecosystem is unique—from the bonding-curve launches on pump.fun to the sophisticated CLMMs on Orca Whirlpools. Your choice depends on your goals, risk tolerance, and management capacity.

Key Takeaways:

- CPMM pools are best for beginners and passive liquidity providers

- CLMM pools offer higher capital efficiency but require active management

- Stable-swap pools are ideal for stablecoin trading and correlated assets

- Bonding-curve pools provide early access but carry extremely high risks

- Jupiter aggregator automatically routes through multiple pool types for optimal pricing

Many new retail traders in Solana’s memecoin scene start with bonding-curve pools for early access, then graduate to traditional AMMs for deeper liquidity. Understanding these differences helps you make informed decisions about where to trade and provide liquidity.

❓ FAQ

Q: When should I choose CLMM over CPMM on Solana?

A: Choose CLMM (like Orca Whirlpools or Raydium CLMM) for active, blue-chip pairs to earn more fees with less capital. Use CPMM (like Raydium v4 or FluxBeam) for simpler, broader market exposure. CLMMs require more active management but offer higher capital efficiency.

Q: Are bonding-curve launch pools safe?

A: No. Bonding-curve pools on pump.fun carry high risks: creator rugs, fake tokens, and post-migration liquidity drying up. They’re for early access but very high risk. Only invest what you can afford to lose.

Q: Why do Solana CLMMs use NFTs for LP positions?

A: NFTs represent unique, non-fungible liquidity positions with specific price ranges. This fits Solana’s NFT culture and allows positions to be traded on marketplaces like Magic Eden. Each NFT can uniquely identify custom parameters.

Q: How does Solana’s design affect pool types?

A: Low fees + high TPS make CLMMs viable for retail (cheap to rebalance ranges, unlike Ethereum). NFT-native LP positions fit Solana’s culture. Aggregators like Jupiter route through multiple pool types automatically, so most users don’t even notice which pool type they’re using.

Q: Which pool type is best for beginners?

A: CPMM pools like Raydium v4 or FluxBeam are best for beginners. They offer simple mechanics, broad market exposure, and require minimal management. You can “set it and forget it” while earning trading fees.

🔗 Related Topics

- What are Liquidity Pools - Understanding the foundation of liquidity pools

- LP Tokens - How LP tokens represent your pool ownership

- Add Liquidity on Solana Guide - Becoming a liquidity provider

- How to Remove Liquidity on Solana - Withdrawing your liquidity