What Are Liquidity Pools on Solana?

Introduction

Think of a liquidity pool like a vending machine for cryptocurrency. Instead of waiting for someone to sell you exactly what you want to buy, you can instantly swap your tokens with a machine that always has inventory. The machine never closes, never runs out of stock, and automatically adjusts prices based on supply and demand.

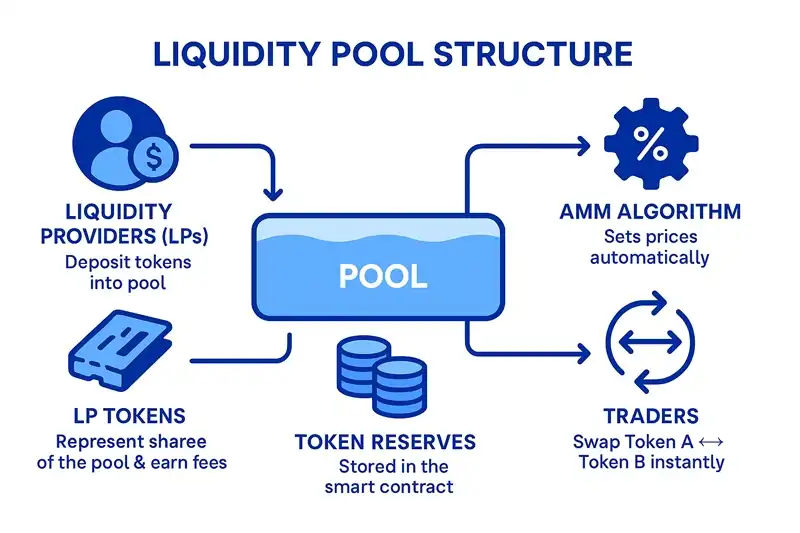

Liquidity pools are fundamental to decentralized finance (DeFi). They are collections of cryptocurrency tokens locked in a smart contract. These pools facilitate trading by providing liquidity for users to swap tokens. Liquidity providers (LPs) contribute assets to these pools and earn fees from trades.

Liquidity Pools - Understanding Automated Market Making on Solana

How Liquidity Pools Work

Simple Definition

An Automated Market Maker (AMM) uses mathematical formulas to price assets. A liquidity pool is the core component of an AMM. It holds reserves of two or more tokens. This system replaces traditional order books. Instead of matching buyers and sellers, users trade directly against the pool’s assets. This ensures continuous trading availability.

Real Example: A SOL/USDC pool on Raydium lets users instantly swap between Solana’s native token and USDC without waiting for a buyer or seller to match their order. The pool automatically calculates the exchange rate and executes the trade in seconds.

Core Components

- Token Reserves: The actual tokens stored in the pool

- AMM Algorithm: Mathematical formula that determines prices

- LP Tokens: Receipts representing ownership shares

- Fee Collection: Automatic fee collection from trades

Why Liquidity Pools Matter

Trading Benefits

- Always-on Market: 24/7 trading availability without intermediaries

- Permissionless Access: Anyone can participate without approval

- Predictable Pricing: Transparent, algorithm-based price discovery

- Instant Execution: No waiting for order matching

Beyond Trading

Liquidity pools are the backbone of Solana DeFi, enabling much more than simple token swaps:

Yield Farming: LPs earn trading fees and often receive additional rewards in governance tokens or other incentives for providing liquidity.

LP Tokens as Collateral: Your LP tokens can be used as collateral for borrowing on lending platforms, unlocking additional DeFi strategies.

Protocol Infrastructure: Every major DeFi protocol on Solana—from lending platforms to derivatives—relies on liquidity pools to function.

Innovation Foundation: New DeFi primitives like concentrated liquidity, dynamic fees, and cross-chain bridges all build upon the liquidity pool concept.

How Swaps Work

Step-by-Step Process

When a user wants to swap Token A for Token B, they interact with the liquidity pool:

- User Submits Token A to the pool

- AMM Algorithm Calculates the amount of Token B to be received

- Trading Fee Applied and distributed among liquidity providers

- Pool Rebalances with new token ratios

- Price Impact Occurs based on trade size and pool depth

Key Concepts

- Price Impact: How much your trade moves the market price

- Slippage: Difference between expected and executed price

- Pool Depth: Total liquidity available for trading

LP Tokens & Fee Generation

Becoming a Liquidity Provider

When you deposit tokens into a liquidity pool, you become a liquidity provider (LP). In return for your deposited assets, you receive LP tokens that represent your proportional share of the pool.

Example: If you deposit 10% of the total liquidity, you receive LP tokens representing that 10% share.

Fee Distribution

- Trading Fees: Small percentage collected from every trade

- Automatic Accrual: Fees accumulate directly in the pool

- Proportional Rewards: Your earnings based on LP token ownership

- Compound Growth: Fees increase the value of your LP tokens over time

Real Example: If a pool collects $100 in fees and you own 1% of the LP tokens, you would earn $1.

Understanding Impermanent Loss

What is Impermanent Loss?

Impermanent loss (IL) occurs when the price of your deposited assets changes compared to when you first provided liquidity. It’s the difference in value between holding your tokens outside the pool versus providing them as liquidity.

Example Scenario

Imagine you deposit 1 SOL and 1000 USDC into a pool when 1 SOL equals 1000 USDC:

- Initial Value: 1 SOL + 1000 USDC = 2000 USDC

- If SOL doubles: 1 SOL = 2000 USDC

- Pool Rebalances: You might withdraw 0.75 SOL and 1500 USDC

- Pool Value: 0.75 × 2000 + 1500 = 3000 USDC

- Holding Value: 1 × 2000 + 1000 = 3000 USDC

- Impermanent Loss: 3000 - 3000 = 0 USDC (in this case, no IL)

Pool Health & Safety Metrics

Key Health Indicators

Assessing a liquidity pool’s health is crucial before providing liquidity:

| Metric | What It Means | Why It Matters |

|---|---|---|

| TVL | Total Value Locked | Higher TVL = deeper liquidity, less price impact |

| 24h Volume | Daily trading activity | High volume = active, popular pool |

| Fees/APY | Expected returns | High APY often means higher risk |

| Pool Age | How long it’s existed | Older pools tend to be more stable |

| Audits | Security verification | Audited pools are generally safer |

Safety Signals

- Legitimate Projects: Verify the pool, mints, and program

- Wallet Integration: Reputable wallets often flag suspicious pools

- Community Verification: Check if the pool is widely recognized

- Documentation: Well-documented pools are typically more trustworthy

AMM Types Comparison

| Type | Description | Pros | Cons |

|---|---|---|---|

| CPMM | Constant Product Market Maker | Simple, predictable, uniform liquidity | Lower capital efficiency |

| CLMM | Concentrated Liquidity Market Maker | Higher capital efficiency, customizable ranges | Requires active management, range-out risk |

| Hybrid | Combines multiple AMM approaches | Best of both worlds | More complex, higher gas costs |

Quick Glossary

- AMM - Automated market maker that replaces traditional order books

- LP Token - Receipt representing your share of the pool

- TVL - Total value locked in the pool (indicates depth/liquidity)

- Slippage - Difference between expected and executed price

- Price Impact - How much your trade moves the market price

- Impermanent Loss - Risk of value loss when providing liquidity vs holding

- Fee Tier - Percentage fee taken per trade (LP revenue)

Risks & Safeguards

Primary Risks

- Smart Contract Risk: Bugs or vulnerabilities in the code

- Oracle/Pricing Issues: External data problems affecting pool performance

- Admin Controls: Centralized controls that could be exploited

- Impermanent Loss: Value loss during volatile market moves

- Range-out Risk: CLMM liquidity becoming inactive outside price range

Safety Measures

- Hardware Wallets: Use secure hardware wallets for large amounts

- Permission Management: Regularly revoke dApp permissions

- Pool Verification: Only use verified, audited pools

- Risk Assessment: Understand the specific risks of each pool type

- Diversification: Don’t put all your liquidity in one pool

📝 Conclusion

Liquidity pools are a cornerstone of decentralized finance that enable permissionless trading and yield generation opportunities. Success as a liquidity provider depends on understanding key factors like pool depth, trading fees, market volatility, and the specific risks involved.

Key Takeaways:

- Liquidity pools provide 24/7 trading without traditional order books

- LP tokens represent ownership and earn fees from all trades

- Impermanent loss is a real risk that must be understood and managed

- Pool health metrics help identify safe, profitable opportunities

- Risk management is essential for long-term success

By carefully evaluating pool health, understanding associated risks, and practicing good risk management, participants can navigate the DeFi landscape more effectively and build sustainable yield strategies.

❓ FAQ

Q: How do LPs earn fees?

A: LPs earn a small percentage of every trade that occurs within the liquidity pool. These fees accumulate in the pool and increase the value of their LP tokens.

Q: What is impermanent loss and when does it matter?

A: Impermanent loss is the temporary difference in value between holding tokens in a liquidity pool versus simply holding them in your wallet. It matters when the price of the deposited assets changes significantly after you provide liquidity.

Q: Why did my swap have price impact?

A: Price impact occurs because your trade changes the ratio of assets within the liquidity pool. Larger trades have a greater impact on the price, especially in pools with lower liquidity.

Q: What’s the difference between CPMM and CLMM?

A: CPMM (Constant Product Market Maker) distributes liquidity uniformly across all prices. CLMM (Concentrated Liquidity Market Maker) allows LPs to focus their liquidity within specific price ranges, leading to higher capital efficiency but requiring more active management.

Q: How do I know if a pool is safe to use?

A: Check the pool’s TVL, trading volume, age, and whether it has been audited. Use reputable wallets that flag suspicious pools, and verify the pool is associated with legitimate projects.

🔗 Related Topics

- How to Create Liquidity Pool on Solana - Setting up your own pool

- Add Liquidity on Solana Guide - Becoming a liquidity provider

- How to Remove Liquidity on Solana - Withdrawing your liquidity

- LP Tokens - Understanding liquidity provider tokens