Solana LP Tokens Explained

Introduction

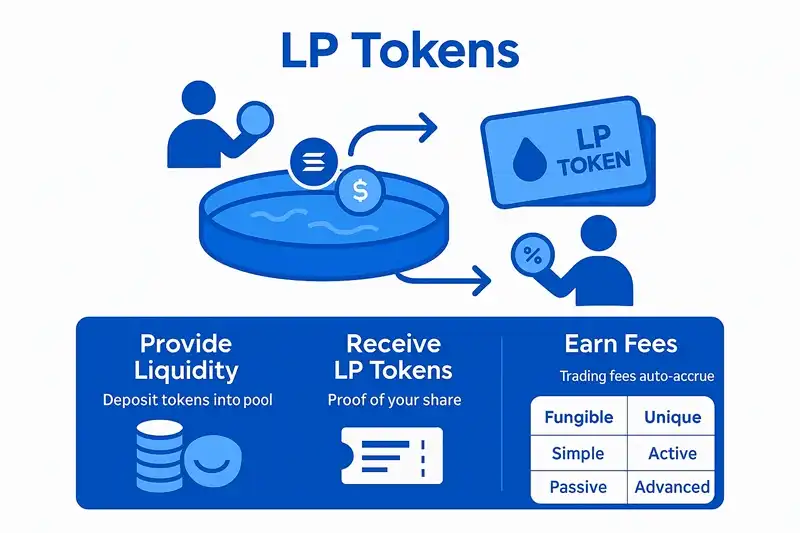

Think of LP tokens as your “pool membership card” — they’re not just receipts, they’re your golden ticket to earning fees and unlocking DeFi’s full potential! When you provide liquidity to a trading pool, the AMM gives you these special tokens that represent your share of the pool’s assets.

But here’s the exciting part: LP tokens are like Swiss Army knives in the DeFi world. They can be staked for extra rewards, used as collateral for loans, or even traded themselves. This page will show you how to turn your liquidity into a powerful, income-generating asset.

LP Tokens - Understanding Liquidity Pool Ownership on Solana

What Are LP Tokens?

Simple Definition

Imagine you’re buying shares in a vending machine business. When you invest $100, you get a certificate showing your ownership percentage. That’s exactly what LP tokens are — digital certificates proving you own a piece of a liquidity pool!

LP tokens = Your ownership certificate for a piece of the trading pool

Some AMMs use position NFTs instead of regular tokens. Think of these like premium memberships that give you access to specific price ranges — like having a VIP table at a restaurant.

Real Solana Examples

Let’s get specific! Here are the LP tokens you’ll actually encounter:

- Raydium CPMM Pools: Get

RAY-SOL LPtokens when you provide SOL + RAY liquidity - Orca Whirlpools: Receive position NFTs representing your concentrated liquidity range

- Jupiter Pools: Earn

JUP-SOL LPtokens for Jupiter ecosystem liquidity - Metaplex Pools: Get

MPLX-SOL LPtokens for NFT marketplace liquidity

Where to Find Your LP Tokens

Wallet Display

- In Your Wallet: LP tokens appear just like regular SPL tokens in Phantom, Solflare, or any Solana wallet

- Pool Dashboard: Check your position on the AMM’s website (Raydium, Orca, etc.)

- Portfolio Trackers: Use tools like Solscan or Solana FM to see all your LP holdings

LP Token Functionality

Core Benefits

Your LP tokens aren’t just sitting there — they’re working overtime:

Staking for Extra Rewards

- Raydium: Stake your

RAY-SOL LPtokens in their farm to earn additional RAY rewards - Orca: Stake Whirlpool positions to earn ORCA tokens

- Jupiter: Stake LP tokens for JUP governance power

Collateral for Loans

- Solend: Use LP tokens as collateral to borrow stablecoins

- Mango Markets: Leverage your LP position for trading

- Francium: Use LP tokens to access leveraged yield strategies

Trading LP Tokens

- Fungible LP tokens can be traded on DEXs (though this is less common)

- Position NFTs can be sold on marketplaces like Tensor or Magic Eden

How LP Tokens Work

Share Calculation

Your share of the pool is like calculating your slice of a pizza:

Your Share = Your LP Tokens ÷ Total LP Tokens

Example: If you own 100 RAY-SOL LP tokens out of 1,000 total, you own 10% of the pool. When the pool has 1,000 SOL and 10,000 RAY, you can claim 100 SOL and 1,000 RAY.

Fee Accrual

Here’s the beautiful part: LP tokens automatically compound your earnings! Every trade in the pool generates fees that go directly into the reserves. As the pool grows, your LP tokens become worth more — it’s like having a savings account that pays interest on your interest!

Most AMMs add fees to reserves (automatic compounding) Some AMMs distribute fees separately (manual claiming)

Understanding Impermanent Loss

What is Impermanent Loss?

Imagine you buy a pizza for $20, but then the price of cheese goes up while tomato prices drop. The total value of your pizza ingredients might change, even though you still have the same pizza. This is impermanent loss — the value of your LP position can fluctuate based on asset price changes.

Key Points

- Good News: Trading fees often offset impermanent loss over time

- Bad News: In volatile markets, you might lose money compared to just holding the assets

LP Tokens vs Position NFTs

| Feature | LP Tokens (Raydium CPMM) | Position NFTs (Orca Whirlpools) |

|---|---|---|

| What you get | Pool membership card | VIP table reservation |

| Fee earning | Automatic into reserves | Claimable per position |

| Management | Set it and forget it | Active monitoring needed |

| Transfer | Easy to send anywhere | NFT transfer (if allowed) |

| Best for | Beginners, passive income | Advanced users, active trading |

Risks & Safety Measures

Primary Risks

- Smart Contract Risk: Use well-audited protocols like Raydium, Orca, or Jupiter

- Impermanent Loss: Understand that prices can move against you

- Admin Controls: Some protocols can upgrade or pause operations

- Toxic Flow: Large traders might exploit your position

Safety Tips

- Use hardware wallets for large positions

- Revoke unused dApp permissions regularly

- Start with small amounts to learn

- Only invest what you can afford to lose

Advanced LP Token Strategies

Yield Farming

Stake your LP tokens in farms to earn additional rewards:

- Raydium Farms: Earn RAY + bonus tokens

- Orca Farms: Earn ORCA + partner rewards

- Jupiter Farms: Earn JUP + governance power

Lending & Borrowing

Use LP tokens as collateral:

- Solend: Borrow stablecoins against LP value

- Mango Markets: Access leveraged strategies

- Francium: Advanced yield optimization

Liquidity Mining

Earn rewards for providing liquidity:

- Protocol incentives: Many projects pay extra for early liquidity

- Governance tokens: Earn voting power in DAOs

- Airdrop eligibility: Some protocols reward active LP providers

📝 Conclusion

LP tokens are your passport to DeFi’s income-generating opportunities! They’re not just receipts — they’re powerful assets that can earn fees, unlock additional rewards through staking, and serve as collateral for loans.

Key Takeaways:

- LP tokens represent ownership in liquidity pools and earn trading fees

- Multiple use cases include staking, lending, and yield farming

- Impermanent loss is a real risk that must be understood

- Safety first - use audited protocols and secure wallets

- Start small and learn the ropes before committing large amounts

Start small, understand the risks, and watch your liquidity work for you in ways that traditional savings never could. LP tokens transform passive deposits into active, income-generating assets.

❓ FAQ

Q: How do LP tokens earn fees?

A: LP tokens earn fees as trading fees accrue into the liquidity pool’s reserves. As the reserves grow, the value represented by each LP token increases, leading to passive compounding of your earnings.

Q: Why did my LP value change even without adding/removing?

A: The value of your LP tokens can change due to price fluctuations of the assets in the pool, which can lead to impermanent loss. Additionally, the accumulation of trading fees within the pool can increase the value of your LP tokens over time.

Q: What’s the difference between LP tokens and NFT positions?

A: Fungible LP tokens represent a proportional share of the entire liquidity pool. Position NFTs, often used in concentrated liquidity pools, represent liquidity provided within a specific price range and may require active management.

Q: How do I estimate my withdrawal amounts?

A: To estimate your withdrawal amounts, calculate your share of the pool by dividing your LP token balance by the total LP token supply. Then, multiply your share by the current reserves of each asset in the pool.

Q: Can I use my LP tokens for anything else?

A: Yes! LP tokens are highly composable. You can stake them in yield farms for extra rewards, use them as collateral for loans, or even trade them in some cases. This “second life” makes them much more valuable than simple receipts.

📚 References and Further Reading

- Solana Documentation - Official Solana developer documentation

- Raydium Documentation - Popular Solana DEX with liquidity pools

- Orca Documentation - Concentrated liquidity AMM on Solana

🔗 Related Topics

- What are Liquidity Pools - Understanding the foundation of liquidity pools

- Pool Types in Solana - Different types of liquidity pools

- Add Liquidity on Solana Guide - Becoming a liquidity provider

- How to Remove Liquidity on Solana - Withdrawing your liquidity