Liquidity Pool Analytics on Solana

Introduction

Think of pool analytics as your “health checkup” for liquidity pools. Just like you wouldn’t invest in a company without checking their financial statements, you shouldn’t provide liquidity without understanding the pool’s metrics. This page will teach you how to read the vital signs of any liquidity pool and make informed decisions about where to deploy your capital.

Why This Matters: On Solana, where new pools launch daily and some can be risky, knowing how to analyze pool health can save you from losing money to rugs, impermanent loss, or low-fee pools that barely generate returns.

Pool Analytics - Understanding Liquidity Pool Health Metrics on Solana

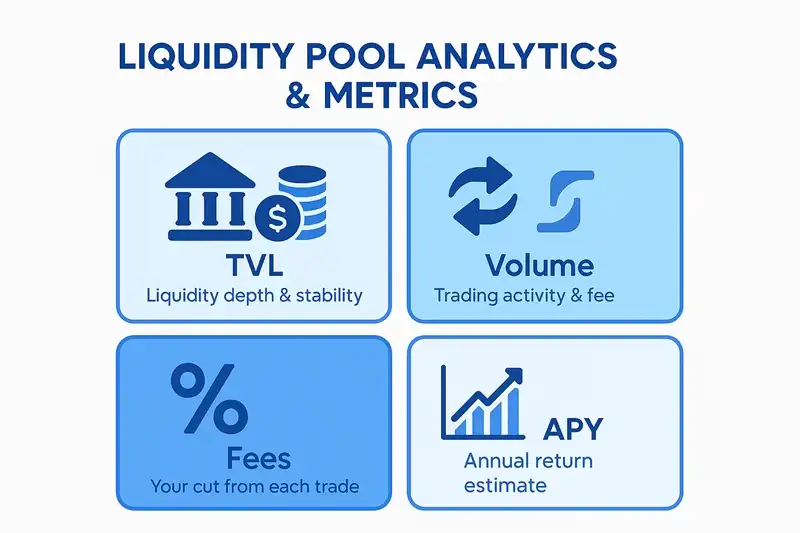

The Big Four: Essential Pool Metrics

Every liquidity pool has four fundamental metrics that tell you everything you need to know:

- TVL (Total Value Locked) - How much money is in the pool

- Volume - How much trading happens daily

- Fees - What percentage you earn per trade

- APY - Your annual return on investment

Let’s break down each one and learn how to interpret them.

TVL Analysis: The Foundation

What TVL Tells You

TVL represents the total dollar value of all assets locked in the pool. Think of it as the pool’s “bank account balance.”

High TVL (over $1M):

- Deep liquidity, low price impact

- More stable trading conditions

- Lower risk of manipulation

- Lower APY (more competition for fees)

Medium TVL ($100k-$1M):

- Good balance of liquidity and returns

- Reasonable price impact for most trades

- Often the sweet spot for retail LPs

Low TVL (under $100k):

- High price impact on trades

- Higher APY potential

- Higher risk of manipulation

- Potential for impermanent loss

TVL Growth Patterns

Healthy Growth: Steady increase over time Unhealthy Patterns:

- Sudden spikes (potential manipulation)

- Sharp declines (LPs withdrawing, red flag)

- Stagnant TVL (low interest, poor returns)

Volume Analysis: The Activity Indicator

Understanding Volume Metrics

Daily Volume shows how much trading activity occurs in 24 hours. This is crucial because:

- Higher volume = more fees for LPs

- Volume patterns reveal market sentiment

- Unusual spikes can indicate manipulation

Volume-to-TVL Ratio

This ratio tells you how “active” the pool is:

Healthy Ratios:

- 0.1-0.5: Normal trading activity

- 0.5-1.0: High activity, good for LPs

- 1.0-2.0: Very active, excellent fee generation

Warning Signs:

- Less than 0.05: Very low activity, poor returns

- Greater than 2.0: Unusual for blue-chip pairs, may indicate manipulation (though memecoin pools can naturally see extreme turnover)

Volume Pattern Analysis

Normal Patterns:

- Consistent daily volume

- Volume follows market trends

- Weekday/weekend variations

Suspicious Patterns:

- Sudden volume spikes

- Unusual trading hours

- Volume doesn’t match market conditions

Fee Analysis: Your Revenue Stream

Understanding Fee Structures

Typical Fee Tiers:

- 0.01%: Ultra-low fees (stablecoin pairs)

- 0.05%: Low fees (major pairs like SOL/USDC)

- 0.3%: Standard fees (most token pairs)

- 1%: High fees (exotic or risky tokens)

Fee Calculation Examples

Daily Fee Revenue:

Daily Volume * Fee Rate = Daily Fees$100,000 * 0.003 = $300 daily feesYour Share of Fees:

Your LP Share * Daily Fees = Your Daily Earnings5% of pool * $300 = $15 daily earningsFee Optimization Strategies

High-Volume, Low-Fee Pools:

- Stable returns, lower risk

- Good for large capital deployment

- Example: SOL/USDC (0.05% fees)

Low-Volume, High-Fee Pools:

- Higher APY potential, higher risk

- Good for smaller capital, higher risk tolerance

- Example: New memecoins (1% fees)

APY Calculations: Your Return on Investment

Basic APY Formula

Simple APY Calculation:

APY = (Daily Fee Revenue * 365) / TVL * 100Real Example:

- Pool TVL: $1,000,000

- Daily Volume: $100,000

- Fee Rate: 0.3%

- Daily Fees: $100,000 * 0.003 = $300

- APY: ($300 * 365) / $1,000,000 * 100 = 10.95%

Advanced APY Considerations

Impermanent Loss Impact:

- High APY doesn’t guarantee profit

- IL can eat into or exceed fee earnings

- Consider both fees and potential IL

Compounding Effects:

- Fees reinvested daily compound returns

- Real APY often higher than simple calculation

- Use compound interest formulas for accuracy

Pool Health Indicators: The Complete Picture

Green Flags (Healthy Pool)

- Consistent TVL growth over time

- Stable volume patterns following market trends

- Reasonable fee structure (0.05%-0.3% for most pairs)

- Audited protocols (Raydium, Orca, Jupiter)

- Established tokens with real utility

- Active community and development

Yellow Flags (Caution Required)

- Fluctuating TVL without clear reason

- Inconsistent volume patterns

- Very high fees (greater than 1%) on established pairs

- New protocols without audits

- Low liquidity (less than $50k TVL)

- Anonymous teams or unclear tokenomics

Red Flags (Avoid These Pools)

- Sudden TVL spikes followed by crashes

- Volume manipulation (fake trading)

- Extremely high APY (greater than 100%) with low TVL

- Unaudited contracts or suspicious code

- Fake tokens or rug pull indicators

- No social proof or community

- Admin key risk (contracts where teams can change fees or pull liquidity if not properly decentralized)

Real-World Analysis Examples

Example 1: Healthy SOL/USDC Pool

- TVL: $5,000,000 (stable, growing)

- Volume: $2,000,000 daily (40% turnover)

- Fees: 0.05% (standard for major pairs)

- APY: 7.3% (realistic, sustainable)

- Verdict: Safe, good for beginners

Example 2: Risky New Memecoin Pool

- TVL: $50,000 (very low)

- Volume: $200,000 daily (400% turnover)

- Fees: 1% (very high)

- APY: 730% (suspiciously high)

- Verdict: High risk, potential scam

Example 3: Medium-Risk New Token Pool

- TVL: $200,000 (moderate)

- Volume: $150,000 daily (75% turnover)

- Fees: 0.3% (standard)

- APY: 49.7% (high but explainable)

- Verdict: Moderate risk, research required

Tools for Pool Analysis

On-Chain Analytics

- Solscan: Pool addresses, TVL, volume

- Solana FM: Real-time pool data

- Birdeye: Comprehensive DeFi analytics

- Jupiter: Pool comparison and routing

Protocol Dashboards

- Raydium: Pool analytics and farming

- Orca: Whirlpool performance metrics

- FluxBeam: Pool health indicators

- Jupiter: Cross-protocol comparison

Third-Party Analytics

- DefiLlama: Cross-chain TVL comparison

- CoinGecko: Token and pool data

- DexScreener: Real-time trading data

Advanced Metrics for Power Users

Impermanent Loss Tracking

- Monitor asset price ratios

- Calculate IL vs. fee earnings

- Use IL calculators for projections

Capital Efficiency

- Compare returns across different pools

- Factor in gas fees and time costs

- Consider opportunity cost of capital

Risk-Adjusted Returns

- Sharpe ratio for pool performance

- Maximum drawdown analysis

- Correlation with broader market

Common Mistakes to Avoid

Chasing High APY Only

- High APY often means high risk

- Consider the underlying fundamentals

- Balance returns with risk tolerance

Ignoring Volume Patterns

- Low volume = low fees regardless of TVL

- Sudden volume spikes need investigation

- Consistent volume is better than volatile

Not Checking Token Fundamentals

- Pool health does not equal token value

- Research the actual project

- Verify token contract addresses

Overlooking Protocol Risks

- Even good pools can have protocol issues

- Check for recent audits and updates

- Monitor community sentiment

📝 Conclusion

Pool analytics are your first line of defense against bad investments in DeFi. By understanding TVL, volume, fees, and APY, you can make informed decisions about where to provide liquidity.

Key Takeaways:

- TVL indicates liquidity depth but doesn’t guarantee safety

- Volume patterns reveal real trading activity vs. manipulation

- Fee structures determine your revenue potential

- APY calculations help compare pool performance

- Health indicators provide comprehensive risk assessment

Remember: high returns often come with high risks, and a healthy pool today doesn’t guarantee safety tomorrow. Start with established pools and protocols, learn the patterns, and gradually explore higher-risk opportunities as you gain experience. Your capital will thank you for doing your homework first.

❓ FAQ

Q: What does TVL tell me about a pool?

A: TVL (Total Value Locked) indicates the total assets deposited in the pool. Higher TVL generally means deeper liquidity, less price impact for trades, and potentially more stable trading conditions. However, high TVL alone doesn’t guarantee safety.

Q: How do I calculate my APY from pool fees?

A: To calculate APY from pool fees: (Daily Fee Volume * Fee Rate * 365) / TVL * 100. For example, if a pool has $100k daily volume, 0.3% fees, and $1M TVL: ($100k * 0.003 * 365) / $1M * 100 = 10.95% APY.

Q: What’s a good volume-to-TVL ratio?

A: A healthy volume-to-TVL ratio is typically 0.1 to 1.0 (10% to 100% daily turnover). Ratios below 0.05 suggest low activity, while ratios above 2.0 might indicate excessive trading or potential manipulation. The ideal ratio depends on the token type and market conditions.

Q: How can I spot a risky pool?

A: Red flags include: extremely high APY (over 100%), very low TVL (under $10k), suspicious volume spikes, unknown token contracts, no audits, and pools created by anonymous teams. Always verify the token address, check for audits, and research the project team.

Q: Should I only look at high APY pools?

A: No! High APY often indicates high risk. Focus on pools with reasonable APY (5-30%) that also have healthy TVL, consistent volume, and audited protocols. Balance returns with risk management for sustainable DeFi participation.

🔗 Related Topics

- What are Liquidity Pools - Understanding the foundation of liquidity pools

- LP Tokens - How LP tokens represent your pool ownership

- Pool Types in Solana - Different types of liquidity pools

- Add Liquidity on Solana Guide - How to become a liquidity provider