How to Add Liquidity to a Solana Token on Raydium (Security-First 2025 Guide)

Learn how to add liquidity to a Solana token on Raydium using DEXArea. A step-by-step guide covering Raydium liquidity pool basics, Standard AMM pools, adding liquidity, burning LP tokens, and understanding impermanent loss.

Launching a Solana token without liquidity is like opening a shop with the doors locked.

If traders can't buy or sell your token instantly, they move on. That's why understanding how to add liquidity to a Solana token on Raydium is essential—especially if you care about trading accessibility, price stability, and long-term holders.

This guide is designed for:

- Solana token creators & project developers

- Meme coin founders and launchpad users

- Crypto investors who provide liquidity to SPL tokens

Not Financial Advice

This guide explains the technical process of adding liquidity on Raydium using DEXArea's tools.

It is not financial or investment advice. Liquidity provision—especially on new or volatile tokens—is inherently risky. You can lose some or all of the funds you deposit. Always do your own research and only use funds you can afford to lose.

In this guide you'll learn:

- What liquidity pools are and why they matter

- What you need to prepare before adding liquidity

- How Raydium compares to other Solana DEXs

- Step-by-step: adding liquidity with DEXArea

- How to lock or burn LP tokens

- Key risks, including impermanent loss

- FAQ

Important

Our focus here is on adding liquidity and securing that pool.

👉 Ready to add liquidity? Start here — Simple, secure, and built for Solana token creators.

1. Understanding Liquidity Pools - Why They Matter

This is the "why" behind every Raydium pool and every DEXArea liquidity action.

What is a liquidity pool?

A liquidity pool is a smart-contract-based reserve where traders can swap between two tokens without using a traditional order book. On Solana, a typical pool might pair:

- Your SPL token (e.g.

DTT) - A quote asset like SOL or USDC

Automated market makers (AMMs) such as Raydium's Standard AMM Pool or CPMM use mathematical formulas to set prices based on the current balances in the pool.

Why liquidity is important for your SPL token

Adequate liquidity:

- Enables smooth trading with lower slippage

- Makes price action more stable and less erratic

- Makes your token more attractive to aggregators, bots, and traders

Without liquidity, even a well-designed token can appear inactive on platforms like DexScreener or Birdeye.

LP rewards: how liquidity providers earn

When you deposit both sides of a pair into a pool, you become a liquidity provider (LP):

- You receive LP tokens (receipts that represent your share of the pool)

- Each trade routed through that pool pays a trading fee

- A portion of those fees is distributed to LPs proportional to their share

That's the core of "DeFi yield" on Raydium: you earn fees by keeping markets liquid.

2. Essential Preparation Checklist (Pre-Launch / Pre-Liquidity)

Before using DEXArea to add liquidity, make sure these foundations are in place. Skipping them can lead to avoidable problems and erode holder confidence.

✅ 2.1 Token status: SPL-compliant and finalized

You should already have:

- A deployed SPL or Token-2022 token on Solana

- A final token mint address shared consistently with your community

- No stray "test" mints confusing users

If you still need to deploy your SPL token, you can use the DEXArea Solana Token Creator to create a production-ready mint with the right authorities and metadata.

✅ 2.2 Wallet setup and SOL budget

Use a compatible Solana wallet such as:

- Phantom

- Solflare

- Backpack, Ledger, etc.

Your wallet must hold:

-

Your SPL token (the one you're supporting with liquidity)

-

Enough SOL to cover:

- The SOL side of your liquidity (if your pair is

SOL / DTT) - Network transaction fees and any account rent

- The SOL side of your liquidity (if your pair is

If you're also handling Raydium liquidity pool creation (e.g. a new Standard AMM pool), expect approximately 0.2 SOL in creation fees plus gas as of late 2025—though this can vary based on network conditions and Raydium's configuration. Even when you're just adding liquidity, it's wise to keep a cushion:

SOL Reserve

Keep at least 0.2–0.5 SOL in the wallet you use for liquidity to avoid "Not enough SOL" errors. Actual costs may vary with network congestion.

✅ 2.3 Important security steps: revoking authorities

These steps are strongly recommended if you want to maximize investor confidence.

Revoke Freeze Authority (or move it to governance)

- A live Freeze Authority allows token balances to be frozen.

- Raydium's interface and many scanners treat this as a risk flag for SPL tokens.

- If your tokenomics don't depend on freezing, consider revoking it entirely.

- If they do, move Freeze Authority into a multi-sig or governance setup, not a hot wallet.

Revoke Mint Authority (a strong trust signal)

If Mint Authority is still active:

- You (or a compromised key) can mint new tokens

- Supply can be diluted and dumped into your own liquidity

Revoking Mint Authority:

- Hard-caps the supply

- Signals to investors that your SPL token's supply is fixed

- Shows up as a trust signal in token scanners and community audits

Important: Revoking authorities is a strong trust signal, but it does not eliminate market risk or guarantee project success. Investors should still do their own due diligence.

DEXArea's authority-management tools can help you safely revoke or transfer these authorities.

✅ 2.4 Token information hygiene

Make sure:

- Your token mint address is correct everywhere

- Your community isn't using an old test mint

- Any liquidity or Raydium links you share match your official SPL token

The AMM doesn't care which mint is "official"—users do.

3. Navigating Solana's DEX Landscape (Raydium First, But Not Alone)

3.1 Why Raydium is a common starting point

Raydium is one of the cornerstone DEXs of the Solana DeFi ecosystem:

- Deep integrations with Jupiter, aggregators, and launchpads

- Support for Standard AMM Pools (CP-Swap), legacy AMM v4, and CPMM

- Farming and staking options for some LP tokens

- Native portfolio views for both mainnet and devnet

That's why this guide focuses on how to add liquidity to a Solana token on Raydium specifically—even though other DEXs exist.

3.2 Quick comparison: Raydium vs. Orca vs. Saber

A brief snapshot:

-

Raydium

- Standard AMM Pool and CPMM

- A common default for new SPL token markets

- Integrated with many Solana tools and wallets

-

Orca

- Simple, user-friendly UI

- Powerful concentrated liquidity (Whirlpools)

-

Saber

- Focused on stablecoin and pegged-asset pairs

- Less commonly used for meme coins and experimental tokens

You can spread liquidity across platforms later, but for launch, Raydium + Standard AMM Pool is often the first step for many projects.

For Raydium liquidity pool creation itself, you can use Raydium's UI or DEXArea's Create Pool tool, then come back here to add more liquidity.

3.3 Where DEXArea fits in (and why devnet support matters)

DEXArea isn't a competing DEX. It's a Solana token toolkit that:

-

Talks directly to Raydium pools (AMM v4 & CPMM)

-

Wraps complex actions into simple tools:

Most importantly, DEXArea supports both:

- Mainnet – for real launches

- Devnet – for full dry-runs with no real value tokens

You can:

-

Create a devnet Raydium pool.

-

Use DEXArea Add Liquidity to provide devnet liquidity.

-

Open Raydium's devnet Portfolio → Liquidity page and see:

- Your pool (e.g.

SOL / DTT) - Your pooled SOL / token amounts

- Your position value—just like it would look on mainnet.

- Your pool (e.g.

This devnet workflow lets you test your entire liquidity process (including LP tokens and portfolio view) before risking real SOL.

4. Step-by-Step Walkthrough: Adding Liquidity on Raydium Using DEXArea

How to Add Liquidity to Solana Token with DEXArea

This is the core transactional section: How to Add Liquidity to Solana Token in practice—using DEXArea's tool connected to Raydium.

About DEXArea and Raydium

DEXArea's Add Liquidity tool builds directly on top of Raydium's Standard AMM pools. All transactions are executed on Solana and interact with Raydium programs on-chain.

You can also add liquidity directly through Raydium's own interface—the underlying pool mechanics are the same. DEXArea provides a streamlined interface with additional features like devnet support and integrated pool information.

The flow below is identical for mainnet and devnet. On devnet, you'll see your position show up in Raydium's "My Portfolio" page under the devnet banner, which is useful for rehearsing your launch.

4.1 Connect wallet and choose network

-

Go to: /solana/add-liquidity

-

Connect your Solana wallet (Phantom, Solflare, etc.).

-

In the top bar, pick:

- Network:

MainnetorDevnet - Priority:

Fast,Turbo, orUltra(fee profile)

- Network:

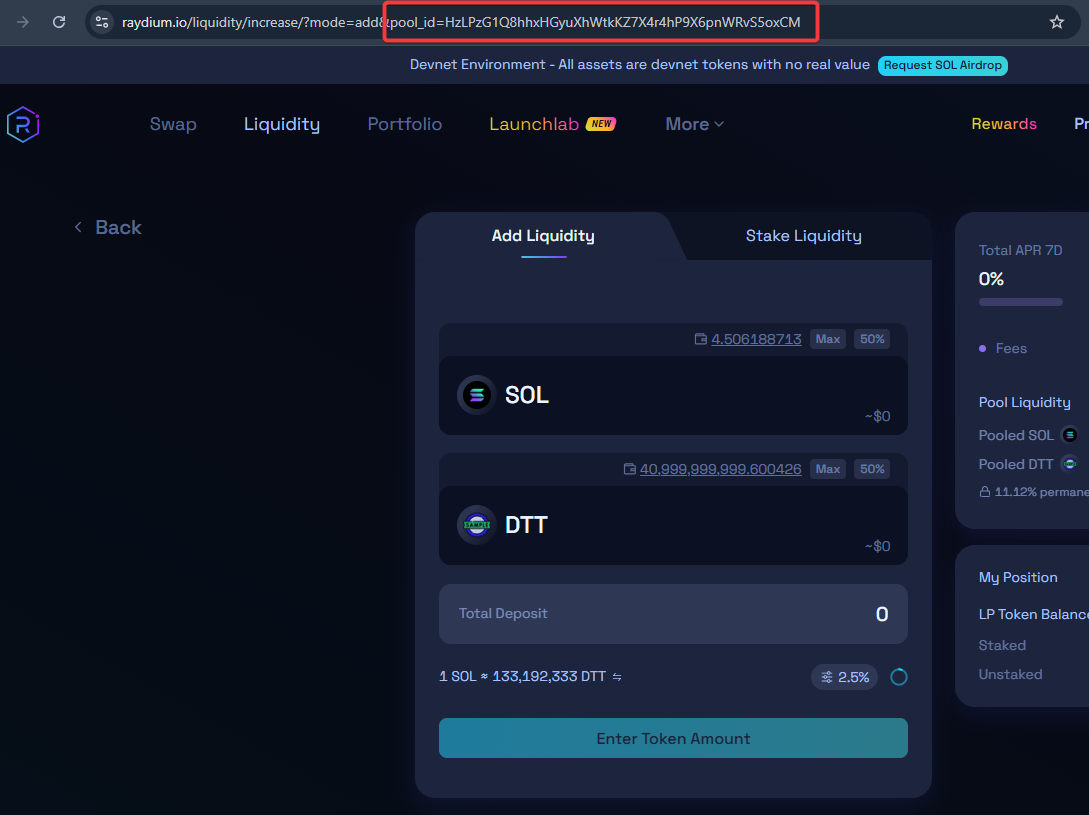

4.2 Enter the existing Raydium pool ID

On the DEXArea Add Liquidity page you'll see a Pool ID field at the top.

Coming Soon: Automatic Pool Detection

In an upcoming update, DEXArea's pool selector will automatically detect pools associated with your connected wallet. You'll be able to instantly choose which pool to add liquidity to—no manual pool ID entry required. For now, you'll need to paste the pool ID manually.

- Paste the Raydium pool ID for your pair (e.g. the Standard AMM pool for

SOL / DTT).

How to find your pool ID on Raydium

-

After a brief loading spinner, DEXArea automatically loads:

- Pool Pair (e.g.

SOL / DTT) - Pool Type:

ammorcpmm(Raydium AMM v4 or CPMM) - Live Price Ratio (

1 SOL = X DTT) - Your LP Balance in that pool

- Your SOL balance and token balance for this wallet

- Pool Pair (e.g.

If the ID is wrong or the pool type isn't supported, you'll get a helpful toast:

"Failed to load pool – this tool only supports Raydium CPMM and AMM v4 pools. Please check the pool ID and try again."

4.3 Define the pair amounts (equal value on both sides)

Under the Pool ID, there are two input rows:

- Quote token side (e.g. SOL Amount)

- Base token side (your SPL token amount, e.g.

DTT Amount)

Each row shows:

- Your wallet balance for that token

- Half and Max buttons for quick selection

You can drive the deposit from either side:

Option A – Start from the quote token (SOL/USDC)

-

In SOL Amount:

- Type the amount of SOL you want to contribute, or

- Click Half (50% of your balance) or Max

-

DEXArea uses the pool's Price Ratio to automatically calculate the matching token amount and fills the DTT Amount field.

Option B – Start from your SPL token side

-

In DTT Amount:

- Type how many tokens you want to contribute, or

- Click Half / Max

-

DEXArea automatically computes the required SOL/USDC amount to keep the deposit balanced at the current AMM price.

Behind the scenes, this keeps you in line with Raydium's constant-product logic and avoids common "invalid deposit" errors.

Guidance for Initial Liquidity

When you first seed a pool, many projects aim for approximately 5–10 SOL worth of initial liquidity to provide reasonable trading depth. Very low liquidity relative to market cap can deter potential buyers. After initial seeding, you can use this DEXArea flow to progressively add more liquidity as your project grows.

4.4 Read the Pool Information panel

The Pool Information card summarizes:

- Pool Pair – the exact token pair

- Pool Type – AMM v4 (amm) or CPMM (cpmm)

- Price Ratio – live on-chain price

- Your LP Balance – current LP tokens held

- SOL Balance and Token Balance – for quick sanity check

This makes sure you're interacting with the right Standard AMM pool or CPMM pool on the right network.

4.5 Review risk: Price Impact Warning

Just below, DEXArea displays a Price Impact Warning box:

"Adding liquidity may result in impermanent loss if token prices change significantly. Make sure you understand the risks before proceeding."

This ties directly into the impermanent loss concept we'll unpack in section 6.

4.6 Confirm Total Fees and add liquidity

0.07 SOL depending on network conditions) and the main Add Liquidity button.- Total Fees summarizes the estimated transaction cost based on your chosen priority profile.

- This is especially useful on mainnet when network conditions are volatile.

When everything looks good:

- Click Add Liquidity.

- Approve the transaction in your wallet.

- Wait for confirmation.

DEXArea never takes custody of your funds; all actions are signed in your wallet and executed directly on Raydium's smart contracts.

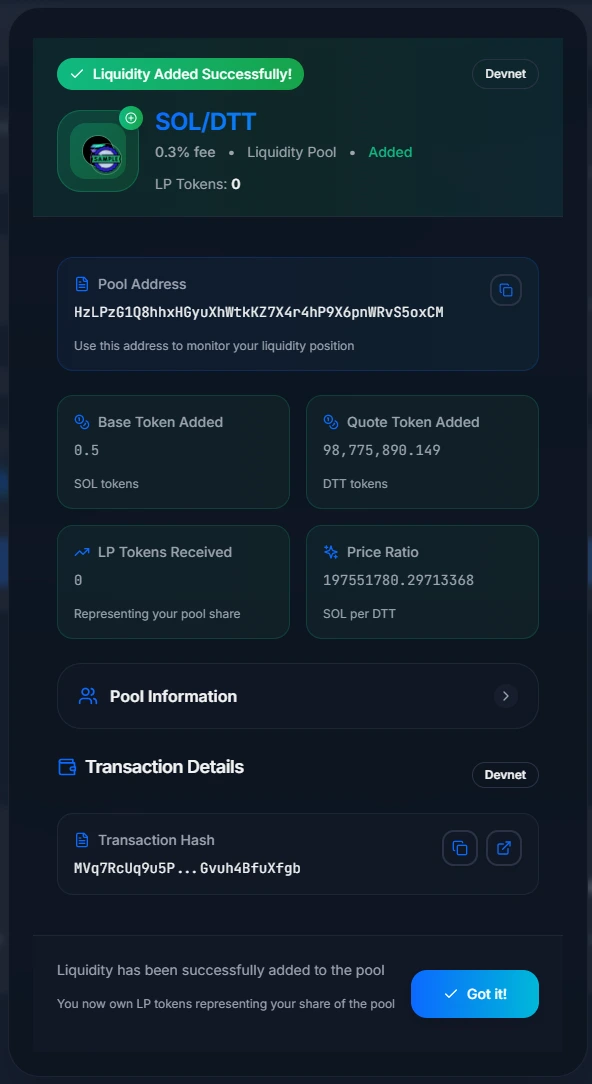

If successful, DEXArea opens a "Liquidity Added Successfully!" confirmation modal showing:

- Pool summary with token pair (e.g.,

SOL / DTT), fee tier, and LP tokens received - Pool address with copy button for monitoring your position

- Transaction details including exact amounts of both tokens deposited, LP tokens received, and current price ratio

- Transaction hash with copy and explorer view buttons, plus network indicator (Mainnet or Devnet)

- Confirmation message and "Got it!" button to close

After closing the modal, DEXArea resets the form, balances, and selected pool state so you start fresh next time.

SOL / DTT, pooled SOL, pooled tokens, total position value) exactly as it would appear on mainnet. That's your full-dress rehearsal.

If anything fails (insufficient balance, RPC problems), you'll see a clear error toast instead of a mysterious crash.

5. Securing the Pool - Locking Liquidity

Now we get to the part investors often focus on: can the team remove the liquidity?

5.1 Why locking liquidity matters

LP tokens are the keys to the vault. Whoever holds them can:

- Withdraw the pooled SOL and tokens

- Leave buyers with no exit liquidity

To build trust, many projects:

- Burn LP tokens (permanent lock), or

- Lock LP tokens in a time-locked contract

When scanners and traders see "100% LP burned/locked", they know the team cannot remove the pool liquidity.

5.2 Burning LP tokens (maximum commitment)

Burning is the strongest form of commitment:

- Use a trusted LP burn tool like DEXArea's Burn Liquidity tool (supports Raydium LP tokens).

- Select your Raydium LP token (corresponding to the pool ID).

- Send/burn the entire LP position or a chosen percentage.

- Verify the LP token balance is now zero in your wallet.

Once burned:

- The LP tokens are gone forever

- The corresponding liquidity is permanently locked inside the Raydium pool

- On scanners like DexScreener, your pool typically shows up with a lock icon or a "100% locked / burned" label

Important: Locking or burning LP is a strong trust signal, but it does not remove market risk or guarantee project success. Token prices can still decline, and impermanent loss still applies.

5.3 Locking LP tokens (time-based commitment)

If you need more flexibility (for migration or treasury management), you can lock LP tokens instead of burning:

- Deposit LP tokens into a timelock / locker contract

- Share the public lock link with your community

- Until the unlock time, LP tokens cannot be moved or redeemed

This still provides strong security guarantees but allows future protocol upgrades.

5.4 Post-launch monitoring

After you've added and secured liquidity:

-

Track your pool on Raydium:

- Volume

- Fees generated

- LP rewards (if any farm exists)

-

Watch the pool on DexScreener / Birdeye:

- Liquidity depth

- Price movements

- Holder distribution

6. Managing Risks and Maximizing Returns

Adding liquidity to a Solana token has potential upside (fees, community trust) and real downside (volatility, impermanent loss). Let's examine both honestly.

You Can Lose All the Funds You Deposit

Before we discuss strategies, this needs to be clear: adding liquidity to a new or volatile token is high-risk.

- If the token price crashes, your LP position loses value

- If the project fails or is abandoned, your deposited assets may become nearly worthless

- If the token is a scam or "rugs," you can lose everything you contributed

Only add liquidity with funds you are fully prepared to lose. This is not a figure of speech—it's a realistic possibility with new tokens.

6.1 What is impermanent loss (IL)?

Impermanent loss is the difference between:

- The value of your LP position

- The value you would have had by simply holding the same tokens in your wallet

When one token's price moves significantly relative to the other, the AMM rebalances the pool. That rebalancing can leave your LP position worth less than just holding, even after you've earned some fees.

If prices revert exactly to the original ratio, the loss disappears (hence impermanent). In trending markets, it often becomes effectively permanent at the moment you withdraw.

If you plotted your position on a simple chart, you would see that as the token's price moves away from your entry price, the value of your LP position diverges from what you would have had by just holding the assets separately. That gap is what we call impermanent loss—and it grows larger as the price divergence increases.

6.2 How to reduce IL

You can't avoid IL entirely in volatile markets, but you can reduce it:

- Pair your token with a stable or highly liquid asset (USDC or SOL).

- Add liquidity during lower volatility periods, not right into major news or listing spikes.

- Avoid putting 100% of your treasury into one LP position; keep a portion unpooled.

6.3 Maximizing returns from LP positions

LPs can earn:

- A share of trading fees from every swap

- Potential farming rewards (RAY or partner tokens) when Raydium or other protocols offer a farm for your LP token

A common approach:

- Seed the pool and add liquidity using DEXArea Add Liquidity.

- Stake LP tokens in Raydium or a partner farm if available.

- Once your project is stable and liquid, consider burning or locking LP to build investor trust.

Just remember: once burned, LP tokens are gone. Plan your farming and treasury strategy first.

FAQ: How to Add Liquidity to a Solana Token on Raydium with DEXArea

Q: What is impermanent loss, and how can I reduce it?

A: Impermanent loss is the difference between the value of your LP position and what you'd have by simply holding the tokens. The AMM rebalances as prices change, which can reduce your position's value compared to holding. To reduce IL:

- Provide liquidity during low volatility

- Pair with stable or correlated assets (USDC or SOL)

- Avoid putting your entire treasury into one LP position

Note that IL can become permanent if you withdraw when prices have diverged significantly from your entry point.

Q: Do I need a lot of SOL to add liquidity?

A: You don't need a large amount, but you do need enough to:

- Fund the SOL side of the pool (if your pair is

SOL / DTT) - Pay network fees (and, if you're creating a Standard AMM Pool, approximately 0.2 SOL in creation costs as of late 2025—though this can vary with network conditions)

Many projects aim for approximately 5–10 SOL worth of initial liquidity, plus a buffer for fees. Always keep some extra SOL on hand to prevent failed transactions.

Q: Why is revoking Mint Authority important?

A: Because liquidity combined with an active mint authority creates risk for holders.

If Mint Authority is active:

- New tokens can be minted

- They can be dumped into your own Raydium pool

- This dilutes value for all holders

Revoking Mint Authority:

- Guarantees a fixed supply

- Tells investors you cannot mint additional tokens

- Is generally considered a strong trust signal

However, revoking authorities does not eliminate market risk or guarantee project success.

Q: Can I remove my liquidity anytime?

A: Yes—unless you have:

- Burned your LP tokens (permanent lock), or

- Locked them in a timelock contract

As long as LP tokens are in your wallet and not locked, you can use either Raydium or DEXArea's Remove Liquidity tool to withdraw your pooled tokens.

Q: How much initial liquidity should I add?

A: It depends on your project, but common guidance is:

- At least 5–10 SOL worth of liquidity

- Enough depth that a typical buy or sell doesn't cause excessive price impact

- Avoid very low liquidity relative to market cap, as this can raise concerns

You can incrementally add more liquidity using DEXArea as your project gains momentum.

Q: Can I add more liquidity later without matching the original ratio?

A: Yes.

When you add liquidity to an existing Raydium pool:

- You deposit equal value (not equal token amounts) of both assets at the current market price

- DEXArea automatically calculates the correct paired amount using the live pool price

You don't need to remember your original launch ratio. The AMM handles the math; DEXArea makes it readable.

Analogy: A vending machine you promise never to empty

Think of your Raydium pool as a vending machine for your token:

- You stock it with your SPL token and SOL/USDC.

- Traders walk up, insert SOL/USDC, and get your token.

- The machine (the liquidity pool) automatically adjusts prices based on what's inside.

Adding liquidity through DEXArea is like using a control panel for that machine:

- It shows what's inside right now.

- It tells you exactly how much of each item to add.

- It shows you the cost and risk before you press confirm.

When you then burn or lock your LP tokens, you're publicly committing:

"This vending machine isn't going anywhere. I've removed my ability to empty it."

That's what many Solana investors look for in 2025:

Not just another SPL token, but a Raydium pool with real liquidity, visible on Raydium's portfolio—even on devnet—and a creator who has demonstrably limited their ability to remove it.

This commitment improves transparency and trust, but it does not remove market risk or guarantee price stability. Token prices can still fluctuate based on market conditions regardless of liquidity locks.

What's Next?

Now that you understand how to add liquidity to a Solana token on Raydium, explore these related tools to build your complete token ecosystem:

- Create Solana Token — Launch your token with proper authorities before adding liquidity

- Create Liquidity Pool — Create a new Raydium Standard AMM pool if you don't have one yet

- Remove Liquidity — Withdraw or rebalance your liquidity position

- Burn Liquidity — Permanently lock liquidity by burning LP tokens

- Mint Solana Token — Increase token supply for airdrops and community rewards